does georgia have an inheritance tax

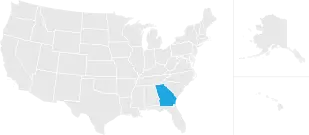

No Georgia does not have an estate tax or an inheritance tax on its inheritance laws. In Georgia most people do not pay any taxes when they die or inherit money or property from someone who has passed on.

Estate Taxes After A Loved One S Death

However Georgia residents may still be on the hook for inheritance taxes if the state where the deceased lived has legislation allowing.

. Only people who die with more than 117 million must pay the federal estate tax and Georgia does not have any special taxes for estates or inheritances. These states have an. This means your children should not have to worry about paying an inheritance tax to the state.

The executor will also pay the creditors as their claims are received. Georgia does not tax Social Security retirement benefits and provides a maximum deduction of 65000 per person on all types of retirement income for anyone 65 or older. Income tax rates in Georgia do have graduated tax brackets but the tiers are concentrated among the lowest incomes making the.

Georgians are only accountable for federally-mandated estate taxes. This means that if you pass away in the state of Georgia your beneficiaries will not. This means that if you pass away in the state of Georgia your beneficiaries will not.

How much inheritance is tax free in Georgia. As of 2014 Georgia does not have an estate tax either. Georgia has no inheritance tax but some people refer to estate tax as inheritance tax.

Georgia has no inheritance tax but some people refer to estate tax as inheritance tax. Georgia has no inheritance tax. However it does not liberate Georgia residents from the Federal Estate Tax if the inheritance exceeds the exemption bar of 1206.

Ive got more good news for you. The good news is that georgia does not have an inheritance tax. Suppose the deceased georgia resident left their heir a 13 million worth of an.

There is no inheritance tax in Georgia. The good news is that Georgia does not have an inheritance tax. No Georgia does not have an inheritance tax.

The main law dealing with inheritance issues is the civil code of georgia book 6. Georgia does not assess and inheritance tax or a gift tax. Georgia Inheritance Tax and Gift Tax.

No Georgia does not have an inheritance tax. It is not paid by the person inheriting the assets. As of July 2014 estates in Georgia no longer have to file estate tax returns or pay estate taxes.

Estate taxes are only mandated in a handful of states and thankfully there is no Georgia inheritance tax. The Global Property Guide. Fortunately unlike some other states Georgia does not have an inheritance tax.

Another states inheritance tax could still apply to Georgia residents though. Georgia residents do not. In Georgia most people do not pay any taxes when they die or inherit money or property from someone who has passed on.

How much inheritance is tax free in Georgia. If you inherited assets from a deceased loved one you may wonder if you have to pay taxes on the property.

Georgia Estate Law Faulkner Law

Estate Planning 101 Your Guide To Estate Tax In Georgia

Georgia Estate Tax Everything You Need To Know Smartasset

Best Estate Tax Planning Lawyer Marietta Ga Faulkner Law

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

No King Charles Iii Won T Pay Any Inheritance Tax On His Massive Gain Georgia Public Broadcasting

Gov Charlie Baker Optimistic About Nearly 700 Million In Tax Break Proposals Including Changes To Massachusetts Estate Tax Masslive Com

Does Georgia Have Inheritance Tax

Georgia Estate Planning Blog Inheritance Estate Tax Trust Management

Georgia Retirement Tax Friendliness Smartasset

Farmers Cry Foul Over Biden S Death Tax Proposal The Georgia Virtue

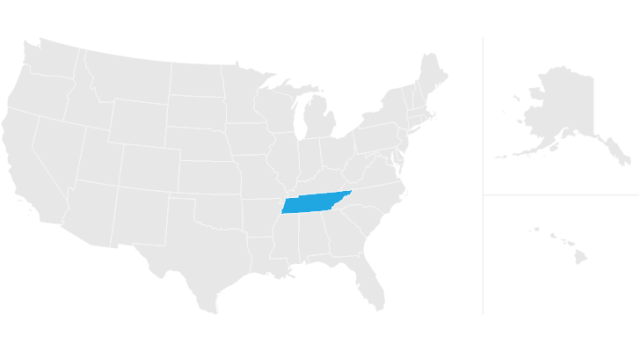

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Georgia Life Estate Deed Form Fill Out Sign Online Dochub

/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated Who Pays It

Estate Planning In Georgia Fouts Jeffery I 9781595719645 Amazon Com Books

Where S My Refund Georgia H R Block

Where Not To Die In 2022 The Greediest Death Tax States

Nebraska Probate Form 500 Inheritance Tax Fill And Sign Printable Template Online